Master of Business Administration: Accounting

Master of Business Administration: Accounting

Accounting Concentration in Rowan's MBA

Why an MBA Concentration in Accounting?

An MBA Concentration in Accounting is an ideal option for those with detail-oriented and analytical mindsets who want a career that draws on their quantitative strengths and their interest in working on cyclical and special projects involving advising, problem-solving, management and planning.

Explore best practices for preparing and utilizing financial reporting statements. Master budgeting processes, operational planning, and advanced accounting principles that are crucial skills in such roles as CPA, tax manager, budget analyst, or auditing manager. Accounting talent is in demand across diverse industries such as:

- insurance;

- health care;

- information technology;

- the public sector; and

- in serving accounting or financial management functions in nonprofit or government.

Long term career goals might include positions such as chief financial officer, financial analyst, or financial manager.

MBA Curriculum Requirements and Options

Core, Customizable, and Foundational Course Requirements

Rowan MBA students complete 18 credits of required coursework to satisfy the core requirements of the 36-credit curriculum. The core requirements can be completed in an individualized order, depending on the student’s needs.

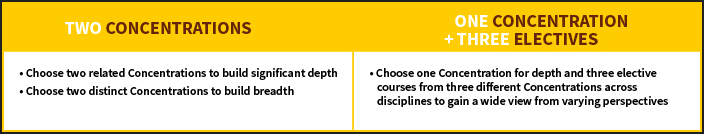

Rowan MBA students also enjoy the freedom to customize the remaining 18 credits (6 three-credit courses) to meet their individual career pursuits. The 18 customizable credits (6 courses) can be arranged to include two areas of concentration or one area of concentration plus three elective courses.

Some foundational coursework may be required, which can be done in a variety of ways, such as equivalent undergraduate courses, noncredit tests, online courses, and community college classes. To see a full list of admission requirements, visit the Rowan University main MBA website page and click Admission Requirements or review our Foundation Fact Sheet. Contact our Program Coordinator at graduatebusinessstudies@rowan.edu for help with Foundation courses.

For pre-admission advising contact the Assistant Director of Global Admissions, Tendai Vengesa, at global@rowan.edu.

How do Specialized Concentrations Work?

Possible Ways to Customize MBA Concentrations at RCB:

Accounting Concentration Coursework

Learn crucial skills for a career path as a CPA, tax manager, budget analyst, and auditing manager and for moving toward VP or Chief Accounting Officer. Master budgeting process and operational planning. Gain insights into subsidiaries, partnerships, intercompany transactions, mergers, and acquisitions.

Rowan MBA students select 3 courses, or 9 credits, from the courses below to build the specialized Accounting Concentration of their choice.

MBA Students have the potential to take more than three classes from the list below, depending on their interests and goals and the flexibility and space available in their individual course of study. Contact an academic advisor from the Graduate Business Studies office at graduatebusinessstudies@rowan.edu if interested in adding any of these classes to your course schedule.

Click on the course titles to review the descriptions.

Coursework—Course Codes, Titles and Descriptions

ACC 03507 - Government and Not-For-Profit Accounting

ACC 03507 - Government and Not-For-Profit Accounting (3 credits)

- This financial accounting course focuses on the contemporary accounting issues of governmental and nonprofit. It includes financial reporting, budgeting, forecasting and strategic planning in the environments of local, state, and federal government, colleges and universities, hospitals, and voluntary health and welfare organizations.

ACC 03510 - Financial Statement Analysis

ACC 03510 - Financial Statement Analysis (3 credits)

- This course will take an expanded study of financial statement analysis from the point of view of the primary users of financial statements: equity and credit analysts. The analysis and use of financial statements will also emphasize the properties of numbers derived from these statements and the features of the environment in which key decisions are made in using financial statement information. Expanded data analytic skills will be emphasized.

ACC 03511 - Introduction to Federal Taxation

ACC 03511 - Introduction to Federal Taxation (3 credits)

- This course provides an overview of federal income tax concepts, including gross income, deductions, credits, gains and losses from dispositions of property, deferred and tax-exempt transactions, assignment of income, tax accounting, and other special topics. Emphasis will be placed on interpreting the Internal Revenue Code and Regulations as well as case law. Students will be required to show evidence of scholarly research through a major writing assignment on an emerging tax issue.

ACC 03512 - Advanced Accounting Information Systems and Business Process Controls

- This course is designed to give the MBA student an introduction to the important concepts related to accounting information systems with emphasis on enterprise risk management. An overview of internal control frameworks is used to discuss pervasive business process and application controls. A methodology for evaluating the risks and controls within a defined business process is demonstrated and applied across the major business processes currently in use. Students will gain hands-on experience with a leading enterprise resource planning (ERP) system and commercial computerized accounting software.

ACC 03599 - Special Topics in Accounting

ACC 03599 - Special Topics in Accounting (3 credits)

-

Students will study advanced topics in Accounting. By design, the specific topical course content will change with time. Contact the Business Graduate Office or the Accounting & Finance Department for details.

Explore More Concentration Options

Students in the MBA program can choose two Concentrations or one Concentration plus three electives. Students also choose their electives from the courses listed in the Concentrations.

To explore other Concentrations in the MBA program, review examples of Concentration combinations, or learn more about courses, click below.

Admissions Information

View admissions requirements, tuition rates, and application deadlines. Connect with Admissions or contact an Admissions Recruiter who can directly answer your questions.

Attend an Information Session

During our Program-Hosted Info Sessions, you'll learn about curriculum options, how our programs fit into a variety of career paths, admissions requirements, tuition and financial aid, and other important points for your planning and decision-making needs.

Learn More About Our Students and Alumni

Our MBA, MS Finance, Certificate students, and alumni bring a wide range of industry experience and varied career goals to the Rohrer College of Business (RCB). To learn more about some of our brightest RCB students and alumni, check out these select stories to get a sense of who might be your new contacts if you join us as a student or the type of talent you might hire if you’re looking to grow your team.