Master of Business Administration: Finance

Master of Business Administration: Finance

Finance Concentration in Rowan's MBA

Why an MBA Concentration in Finance?

An MBA Concentration in Finance is an ideal option for those who have an affinity for working with numbers and are interested in pursuing a career that will build on their quantitative strengths and analytical skills. Taking one or two Finance Concentration courses as electives is also a valuable option for MBA students looking to support their personal financial planning or prepare for future entrepreneurship.

Explore finance as the backbone of every business and understand how money plays a key role in an organization's overall success by leaders making decisions through the use of financial statements and other internal company reports.

Financial skills are crucial for financial analysis, cash management, retirement planning, capital budgeting, investing, and securities management. Finance skills are in demand across industries and have no geographical limit. An MBA with a Finance Concentration can offer a wide range of jobs in nearly every sector, from fintech to healthcare to government, nonprofit, and much more. Finance training and expertise can lead to careers in roles such as:

- managers or VPs in banking, mutual fund, or insurance companies;

- Certified Financial Planner (CFP); and

- Chartered Financial Analyst (CFA).

In the corporate finance area, potential jobs might include:

- risk manager

- corporate controller;

- accounting manager;

- financial or budget analyst;

- financial manager; or

- chief financial officer.

To target a specific career trajectory in finance, students should consider organizing their Finance Concentration courses as follows:

- Corporate Finance: Financial Statement Analysis, Derivative Securities and Financial Risk Management, Financial Modeling, and Multinational Finance Management

- Investment/Asset Management Companies: Investment Analysis and Portfolio Management, Fixed Income Securities, Derivative Securities and Financial Risk Management, and Financial Statement Analysis

- Commercial Banking: Financial Institutions Management, Multinational Finance Management, Derivative Securities and Financial Risk Management, Financial Statement Analysis (for Credit Analysts)

- Personal Finance and Retirement Planning: Advanced Financial Planning and Investment Analysis and Portfolio Management

A career in finance presents unlimited opportunities for achievement and reward. Whether a career in finance is played out on a local or global stage, driving success for a small business, major corporation, or in a personal passion area that intersects with business, it has intrinsic flexibility and reach that can be aligned with one’s own ethics, aspirations, and life pursuits.

MBA Curriculum Requirements and Options

Core, Customizable, and Foundational Course Requirements

Rowan MBA students complete 18 credits of required coursework to satisfy the core requirements of the 36-credit curriculum. The core requirements can be completed in an individualized order, depending on the student’s needs.

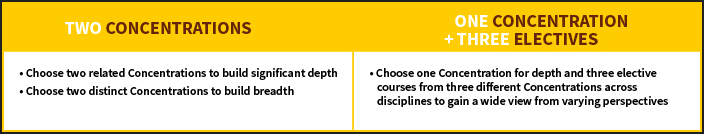

Rowan MBA students also enjoy the freedom to customize the remaining 18 credits (6 three-credit courses) to meet their individual career pursuits. The 18 customizable credits (6 courses) can be arranged to include two areas of concentration or one area of concentration plus three elective courses.

Some foundational coursework may be required, which can be done in a variety of ways, such as equivalent undergraduate courses, noncredit tests, online courses, and community college classes. To see a full list of admission requirements, visit the Rowan University main MBA website page and click Admission Requirements or review our Foundation Fact Sheet. Contact our Program Coordinator at graduatebusinessstudies@rowan.edu for help with Foundation courses.

For pre-admission advising contact the Assistant Director of Global Admissions, Tendai Vengesa, at global@rowan.edu.

How do Specialized Concentrations Work?

Possible Ways to Customize MBA Concentrations at RCB:

Finance Concentration Coursework

Prepare for a career path in finance, from security analysis, wealth and investment management, to financial or loan management, investment banking, personal financial advising, and retirement planning. Delve into financial coursework that combines quantitative techniques with practical experience. Ideal for those in pursuit of Certified Financial Planner (CFP) and Chartered Financial Analyst (CFA) certifications.

Rowan MBA students select 3 courses, or 9 credits, from the courses below to build the specialized Finance Concentration of their choice.

MBA Students have the potential to take more than three classes from the list below, depending on their interests and goals and the flexibility and space available in their individual course of study. Contact an academic advisor from the Graduate Business Studies office at graduatebusinessstudies@rowan.edu if interested in adding any of these classes to your course schedule.

Click on the course titles to review the descriptions.

Coursework—Course Codes, Titles and Descriptions

FIN 04511 - Quantitative Methods in Finance

FIN 04511 - Quantitative Methods in Finance (3 credits)

- The objective of this course is to teach students the fundamentals of quantitative finance. The topics covered in the course include asset returns and time value of money, probability and statistics in their applications to financial analysis, portfolio theory and asset pricing models, regression and econometrics for financial data analysis, structure and pricing of financial derivatives, risk quantification and management.

ACC 03510 - Financial Statement Analysis

ACC 03510 - Financial Statement Analysis (3 credits)

- This course will take an expanded study of financial statement analysis from the point of view of the primary users of financial statements: equity and credit analysts. The analysis and use of financial statements will also emphasize the properties of numbers derived from these statements, and the features of the environment in which key decisions are made in using financial statement information. Expanded data analytic skills will be emphasized.

FIN 04600 - Investment Analysis and Portfolio Management

FIN 04600 - Investment Analysis and Portfolio Management (3 credits)

- In this course students will analyze and develop an ability to deal with the following topics: investment values and market price with regard to risk, return, portfolio diversification, taxes and inflation. Students will also examine the role of fixed income securities versus common stock prices, yields, returns and valuations, warrants, options and future contracts, U.S. and foreign securities markets, and the rapidly developing science of portfolio management as it applies to both the firm and the individual.

FIN 04530 - Multinational Financial Management

FIN 04530 - Multinational Financial Management (3 credits)

- The objective of this course is to examine the managerial implications pertaining to the financial operations of multinational firms and investments in the international arena. The standard topics in international finance, such as exchange rate determination, foreign exchange risk (exposure), hedging techniques (using derivatives), international corporate valuation and capital budgeting, and sources of funds and the cost of capital in the international bond, stock, and money markets are examined from a managerial point of view.

FIN 04518 - Derivative Securities and Financial Risk Management

FIN 04518 - Derivative Securities and Financial Risk Management (3 credits)

- In this course students will learn derivatives pricing models such as forward, future, option and swap contracts, hedging, and arbitrage. In addition, securitization and risk management concepts will be covered. Students will learn how to model and evaluate derivative instruments and their applications to corporate strategy and risk management.

FIN 04560 - Fixed Income Securities

FIN 04560 - Fixed income Securities (3 credits)

- The objective of this course is to teach students the fundamentals of fixed income markets, covering different fixed income security types, and the mathematics of their evaluation and risk management. The topics covered in the course include fixed income security valuation, term structure of interest rates and the yield curve, fixed income risk quantification and management, securities with embedded options, credit derivatives, interest rate derivatives, and portfolio management.

FIN 04520 - Financial Modeling

FIN 04520 - Financial Modeling (3 credits)

-

The objective of this course is to teach students the fundamentals and practice of building financial models by using Microsoft Excel. Students become familiar with the built-in-functions of Excel and learn how to use them in financial model building with a hands-on-approach. The topics covered in the course include financial statement modeling, cost of capital, capital budgeting modeling, leasing, valuation analysis, portfolio modeling, capital-asset pricing models, option-pricing models, real options modeling, bonds, and term structure modeling.

FIN 04505 - Advanced Financial Planning

FIN 04505 - Advanced Financial Planning (3 credits)

- Financial planning is the process of meeting life goals through the proper management of finances. Life goals can include buying a home, saving for your child's education or planning for retirement. Through sound financial planning individuals can make decisions that will produce their desired results. In this course, students will learn foundations of financial planning, managing basic assets, managing credit, managing insurance needs, managing investments and preparing for retirement and estate planning.

FIN 04540 - Financial Institutions Management

FIN 04540 - Financial Institutions Management (3 credits)

- In the course, students will learn about the many roles financial service-providers play in the economy today. Students will examine how and why the financial services marketplace as a whole is rapidly changing, becoming new and different as we move forward into the future. Students will also learn the techniques on how to measure and manage various financial risks the modern financial institutions face in today’s globally competitive financial environment, such as interest rate, market, credit, liquidity, off balance sheet, foreign exchange, sovereign, technology and other operational risks.

FIN 04512 - Capital Budgeting

FIN 04512 - Capital Budgeting (3 credits)

- This course includes the following topics: estimation of project cash flows, interest, annuity, and present value calculations, evaluation of projects under conditions of certainty and risk, strategic planning in capital budgeting, and leasing.

FIN 04516 - Issues in Finance

FIN 04516 - Issues in Finance (3 credits)

- This course includes the following topics: mergers and acquisitions, financial structure analysis, cost of capital analysis, capital budgeting, portfolio management, financial institutions, money and capital markets, and international finance.

Explore More Concentration Options

Students in the MBA program can choose two Concentrations or one Concentration plus three electives. Students also choose their electives from the courses listed in the Concentrations.

To explore other Concentrations in the MBA program, review examples of Concentration combinations, or learn more about courses, click below.

Admissions Information

View admissions requirements, tuition rates, and application deadlines. Connect with Admissions or contact an Admissions Recruiter who can directly answer your questions.

Attend an Information Session

During our Program-Hosted Info Sessions, you'll learn about curriculum options, how these programs fit into a variety of career paths, admissions requirements, tuition and financial aid, and other important points for your planning and decision-making needs.

Learn More About Our Students and Alumni

Our MBA, MS Finance, Certificate students and alumni bring a wide range of industry experience and varied career goals to the Rohrer College of Business (RCB). To learn more about some of our brightest RCB students and alumni, check out these select stories to get a sense of who might be your new contacts if you join us as a student or the type of talent you might hire if you’re looking to grow your team.